Knowledge as a Resource – Absorptive Capacity

Absorptive capacity (ACAP) refers to the conditions that allow firms to incorporate outside innovations. A Popular metric of a firm’s ACAP is research and development (R&D) input (e.g., the amount of money or share of revenue a firm devotes to R&D). Beyond simply increasing R&D input, ACAP also depends on whether or not a firm has continuously invested in R&D. Employee education level (i.e., share of employees with higher education in total employee) is associated with ACAP and diversity of backgrounds among R&D personnel can help an organization maximize “novel associations and linkages.” Organizational structure and knowledge management culture within a firm, as well as the type of knowledge to be learned externally (e.g., intra- versus inter-industry; science-based; private-to-public or public-to-private sector) also impact a firm’s ACAP.

R&D Input

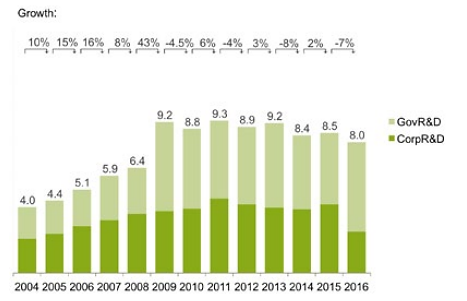

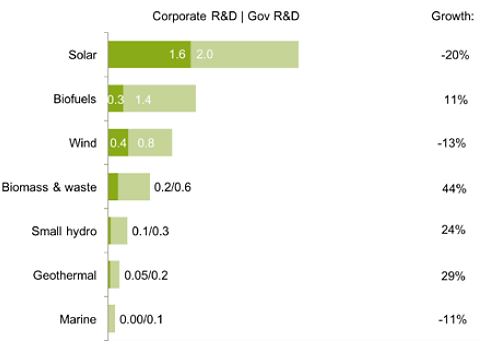

Generally, a firm’s R&D input has a strong correlation to the number of patents it generates. Figure KC.1 shows global R&D input to renewable energy over time, which increased through 2009 and then flattened. In the US in 2016, the only notable R&D funding for wind technologies came from the government (see Table KC.1). Globally, wind R&D tends to be government-funded as well (see Figure KC.2).

Figure KC.1 Global R&D Investment in Renewable Energy, 2004-2016, $BN

Source: Figure 54 from Global Trends in Renewable Energy Investment 2017, original data from Bloomberg, Bloomberg New Energy Finance, IEA, IMAF, various government agencies

Table KC.1. Renewable Energy Investment in the US by Sector and Type, 2016, $BN

Source: Recreated from Figure 15 in Global Trends in Renewable Energy Investment 2017, original data from UN Environmental , Bloomberg New Energy Finance

| Energy Source | Asset finance | Reinvested equity | SDC | Public markets | VC/PE | Corporate R&D | Government R&D | Total |

| Solar | 14.7 | -0.8 | 13.1 | 0.2 | 1.7 | 0.3 | 0.1 | 29.3 |

| Wind | 14.7 | -0.6 | — | 1.1 | 0.2 | 0.0 | 0.1 | 15.5 |

| Biofuels | 0.1 | — | — | 0.0 | 0.3 | 0.1 | 0.6 | 1.0 |

| Geothermal | — | — | — | — | — | 0.0 | 0.1 | 0.1 |

| Biomass & waste | 0.2 | — | — | — | 0.1 | 0.0 | 0.1 | 0.4 |

| Small hydro | 0.1 | — | — | — | 0.0 | 0.0 | 0.0 | 0.1 |

| Marine | — | — | — | — | 0.0 | 0.0 | 0.0 | 0.1 |

| Total | 29.8 | -1.5 | 13.1 | 0.0 | 2.3 | 0.5 | 1.0 | 46.4 |

Note: SDC: Small Distributed Capacity. Total values include estimates for undisclosed deals; VC/PE: Venture capital and private equity.

Figure KC.2 Renewable Energy R&D Global Investment by Technology Type

Source: Figure 55 from Global Trends in Renewable Energy Investment 2017, original data from Bloomberg, Bloomberg New Energy Finance, IEA, IMAF, various government agencies

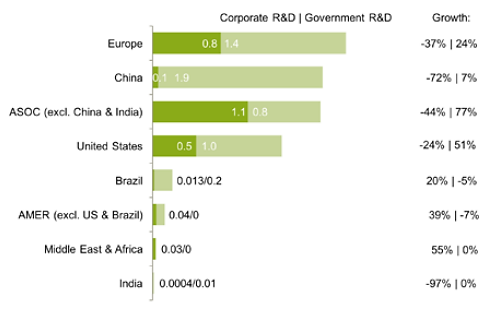

Figure KC.3 Renewable Energy R&D Global Investment by Region

Source: Figure 56 from Global Trends in Renewable Energy Investment 2017 (McCrone et al. 2017), original data from Bloomberg, Bloomberg New Energy Finance, IEA, IMAF, various government agencies

Knowledge Creation

Patent Quantity

Using the number of patents generated as a proxy for knowledge creation is an imperfect yet useful way to measure innovation. Patent counts are a particularly helpful metric of pre-commercial innovation output. Other similar indicators include publications, licenses, and tacit knowledge “know-how”. The wind industry is highly globalized, and accordingly, wind knowledge creation and spillover are also geographically dispersed. Because not all inventions are patentable and because patenting is not always perceived by firms as the most efficient and effective protection tool, the propensity to patent differs across firms, industries and the type of innovation. Firms must first exhibit innovation capabilities necessary to producing patentable knowledge and then have willingness to patent.

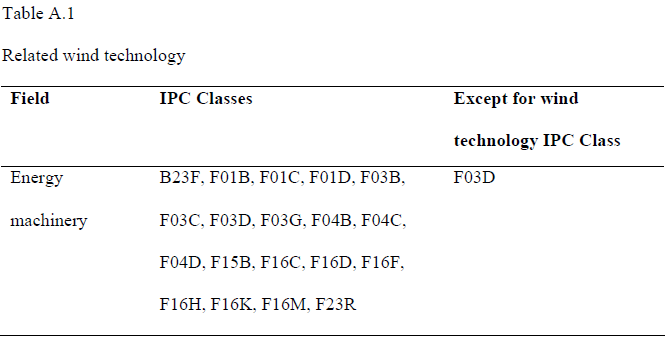

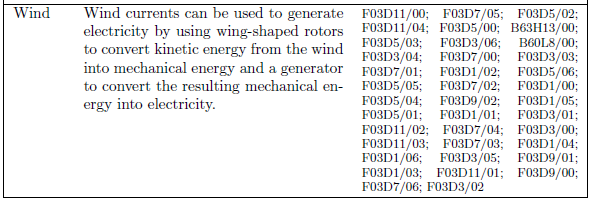

Knowledge relevant to wind technology is generated from diverse disciplines. Most energy innovations are not developed specifically by energy companies; instead, they enter the sector embodied in specialized equipment or innovative fuels from other sectors. IPC categories relevant to wind technology can be found in Table KC.2. Wind energy technology patents are broken down into subclasses covering such components as: wind guiding, rotors, blades, hubs, horizontal versus vertical axis, controls, special use adaptations, etc. Information on wind technology patents can be found in numerous patent search databases including the United States Patent and Trademark Office (USPTO), the European Patent Office (EPO), Derwent World Patents Index, World Intellectual Property Organization, and Google Patents, etc . Information on wind technology patents can be found in numerous patent search databases including the United States Patent and Trademark Office (USPTO), the European Patent Office (EPO), Derwent World Patents Index, World Intellectual Property Organization, and Google Patents, etc.

Table KC.2 Descriptions of IPCs Relevant to Wind Technology

Sources: Nesta et al. (2014) Environmental Policies, Competition and Innovation in Renewable Energy, Journal of Environmental Economics and Management, 67 (3): 396-411; Braun et al. (2010) Innovative Activity in Wind and Solar Technology: Empirical Evidence on Knowledge Spillovers Using Patent Data, Discussion Papers of DIW Berlin 993, German Institute for Economic Research.

Figures KC.4 and KC.5 illustrate the current knowledge landscape of wind energy technology, as compiled from many sources of patents. Figure KC.4 represents wind patent evolution in the US, while Figure KC.5 presents a global overview of recent wind patents by country. Note that these results represent a general summary and trend in knowledge stock, and do not reflect the nuance of the search terms, data sources, and scope defined by each of the individual studies.

Figure KC.4 Accumulated Patent Evolution of Wind Energy Technology in the US

Source: (IRENA, 2017). Technology Report for Wind Power. Original data from EPO PATSTAT.

Figure KC.5 Global Overview on Wind Patents (accumulated patent counts 2000-2016)

Source: (IRENA, 2017) Technology Report for Wind Power, categories: Blades or rotors (Y02E 10/721), Components or gearbox (Y02E 10/722), Generator or configuration (Y02E 10/725), Nacelles (Y02E 10/726), Onshore towers (Y02E 10/728), Wind energy (Y02E 10/70), Wind power (Y02E 10/30). Original data from EPO PATSTAT.

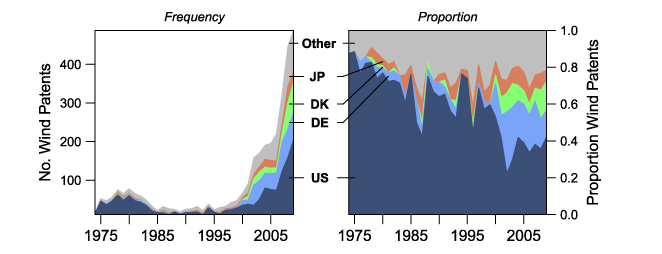

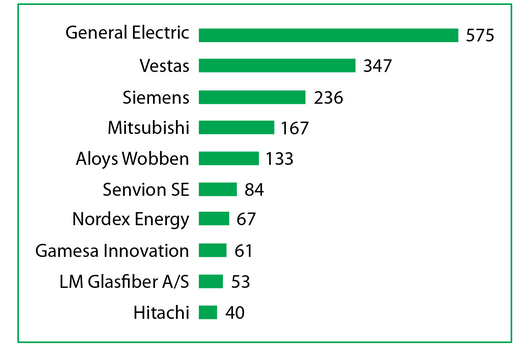

In recent years, the US, Germany, and Denmark have dominated the wind technology patenting landscape (Figure KC.6, compare to Figure KC.5 for global patenting). Today, US patents represent a lower share of the total wind patents compared to 20-30 years ago, but the overall number of wind technology-related patents has increased dramatically. Within the US, ten companies own approximately 45% of wind power patents (see Figure KC.7).

Figure KC.6 Domestic and foreign wind patenting activity in the US patent database

Source: Figure 2 from Horner et al. (2013) Effects of government incentives on wind innovation in the United States, Environmental Research Letters, 8(4).

Figure KC.7 Top wind patent assignees in US

Source: https://stonecreek.us/wind-power-industry-patent-essentials/

Bibliometric Analysis

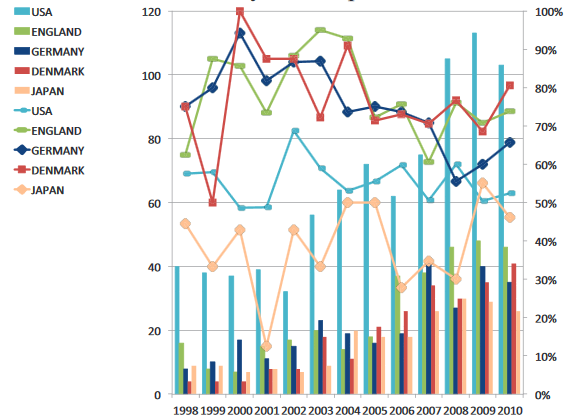

Bibliometric analysis applies quantitative and statistical methods to study trends in the quantity and quality of published materials (e.g., journal articles); it includes authorship, citation, and journal analysis, as well as analysis of publication impact. Bibliometric analysis can be used to track trends in publication regarding renewable energy, including tendency to discuss specific topics and technologies, as well as any changes in the primary geographic sources of publication. Figure KC.8 presents the annual number of publications regarding wind power by author country. Sakata et al. (2011) find that the US consistently has the highest number of wind publications, but ranks much lower in terms of collaboration with international co-authors.

Figure KC.8 Number of publications and share of international co-authorship (wind power) 1998-2010

Source: Figure 1a from Sakata et al. (2011) Structure of International Research Collaboration in Wind and Solar Energy, Proceedings of the 2011 IEEE IEEM.

Knowledge Spillover

Knowledge spillover is hard to measure because it tends to be less tangible or readily observable than other innovation metrics. Spillover can be considered between companies, between public and private institutions, and across geographies. At the national level, both intra-sectoral and inter-sectoral spillovers have been influential in innovative activity in wind technologies; however, while the market for wind technologies is international, knowledge spillovers between nations do not appear to be strong drivers of innovation in the wind sector (Braun, et.al. 2010).

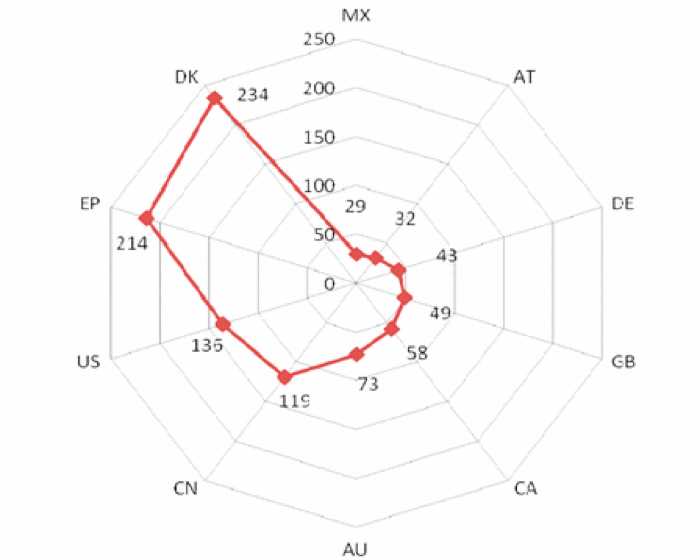

Firms often aim to appropriate the returns of innovation (i.e., prevent knowledge spillover) through patents or secrecy. Backward and forward citation of patents can reveal connections between the knowledge imbedded in technologies; backward citation refers to patents cited inthe patent of interest, while forward citation refers to patents citingthe patent of interest. Patent citation and patent family size are commonly used to measure patent quality. Patent family size refers to the number of patents taken multiple countries to protect the same invention; Figure KC.9 graphically presents the geographies of the wind technology patents of Vestas. Braun et al. (2010) find that an increase in the national wind technology knowledge stock of 1% is associated with 0.83% increase in wind patents on average. Kim et al (2018) confirmed that a renewable energy firm’s patent protection ability is important for its financial performance. They also found that the backward citation of patents and the size of patent families, more so than simple patent counts, are important measures of the ability of firms in this industry to protect the knowledge they develop.

Figure KC.9 Number of Vestas wind technology patents by country

Source: Figure 3 from Kapoor et al. (2012) Patent value indicators: Case of emerging wind energy markets, 2012 Proceedings of PICMET ’12: Technology Management for Emerging Technologies.

Note that each axis represents a country or region (e.g., AU is Australia, MX is Mexico, EP is Europe, etc)

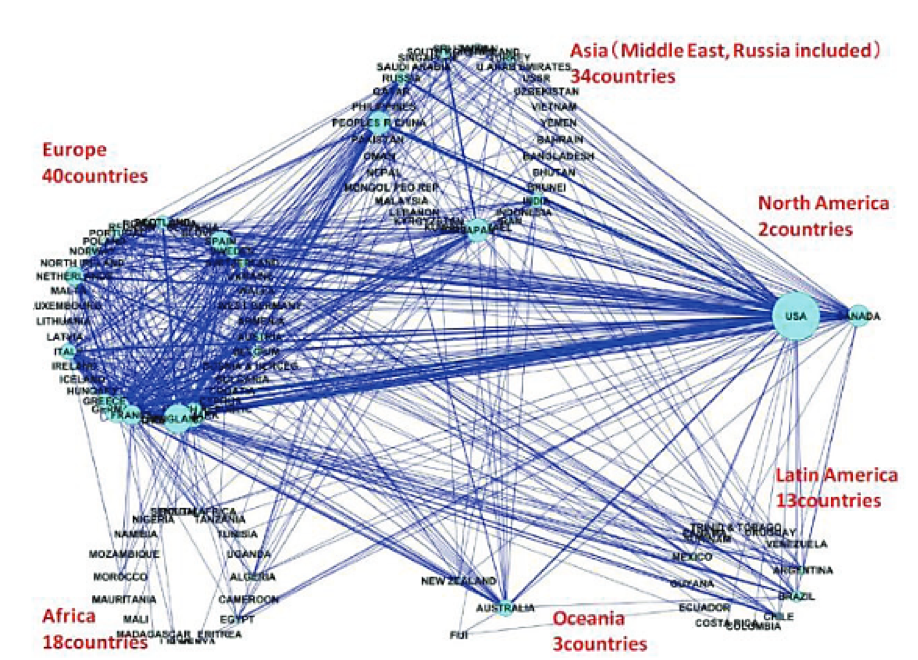

Research Collaboration

Knowledge can also spread as teams collaborate on research and publication. Network analysis, the characterization and investigation of social structures through graphs of nodes (e.g., people, things) and linkages (e.g., relationships, interactions), can be used to explore the connections between different groups of researchers involved in the same field of study. Figure KC.10 provides an illustration of collaborative network formed by wind energy researchers as compiled by Sakata et al. (2011). Note that European nations represent a hub of publishing collaboration. The thickness of each link between two nodes represents the shares of international co-authorship on wind energy-related publications.

Figure KC.10 Wind co-authorship international collaboration network

Source: Figure 2a from Sakata et al. (2011) Structure of International Research Collaboration in Wind and Solar Energy, Proceedings of the 2011 IEEE IEEM.

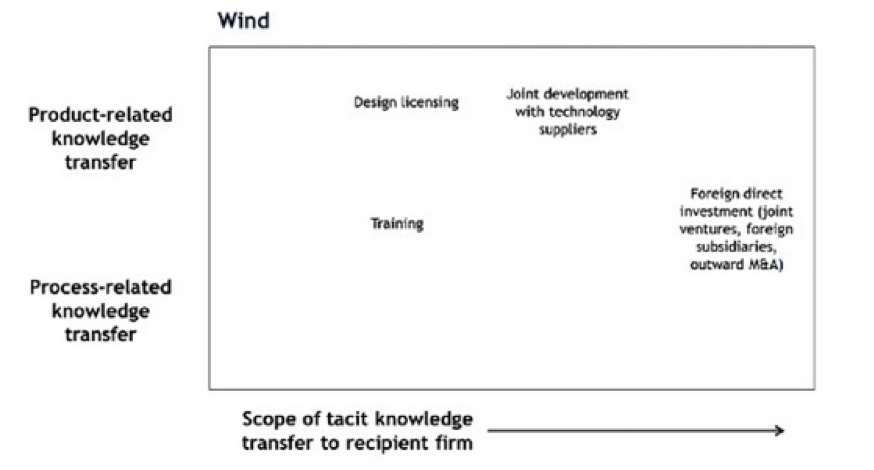

Tacit Knowledge Transfer

Tacit knowledge is a primary source of research spillovers because this type of knowledge is embodied in the skills of the firm’s employees. Tacit knowledge includes rules of thumb, heuristics, and tricks of the trade, as compared to the knowledge embodied in a technology; it may be related to products or processes. Informal exchanges between researchers and job turnover between firms are channels through which tacit knowledge flows from one firm to the other (Kaiser, 2002). Indicators such as number of R&D personnel and innovation expenditure could be considered a proxy for tacit knowledge transfer, although the validity of this proxy will depend on the type of tacit knowledge to be transferred. Generally, intrafirm transfer modes involving a high level of direct human interaction (e.g., joint ventures, international research centers) are more effective than so-called arms-length transfer mechanisms. Tacit knowledge can be exchanged through human resource transfer, training, joint R&D programs, process licensing, trade in production equipment, and trade in turnkey production facilities (Quitzow, Huenteler, & Asmussen, 2017). Figure KC.11 provides an example of international tacit knowledge transfer for wind technology.

Figure KC.11 An example of international tacit knowledge transfer for wind energy technology

Source: Quitzow et al. (2017)Development trajectories in China’s wind and solar energy industries: How technology-related differences shape the dynamics of international competition and knowledge transfer. Journal of Cleaner Production, 158, 122–133.