Absorptive Capacity (ACAP):

Absorptive capacity (ACAP) refers to the conditions that allow firms to incorporate outside innovations. Research and development (R&D) input (e.g., the amount of money or share of revenue a firm devotes to R&D) is a common metric used to compare ACAP across firms. Other factors, including employee education level (i.e., share of employees with higher education in total employee) and diversity of backgrounds among R&D personnel, are associated with increased ACAP.

Four Firm Concentration Ratio (FFCR):

The Four Firm Concentration Ratio (FFCR) is a simplified alternative to the Herfindahl-Hirschman index (HHI); it measures the percent of total industry revenue accruing to the largest four firms in the industry. Concentration ratios show the extent of market control of the largest firms in the industry and illustrate the degree to which an industry is oligopolistic.

General guidance to interpret the value of FFCR:

- Low concentration (0%-50%) –> this category ranges from perfect competition to an oligopoly

- Medium concentration (50%-80%) –> an industry is likely an oligopoly

- High concentration (80%-100%) –> this category ranges from an oligopoly to monopoly

The FFCRs for the entire U.S. manufacturing sector are reported by the Economics Census every five years. The Census also reports concentration ratios for the eight, twenty, and fifty largest firms in each industry.

Herfindahl-Hirschman Index (HHI):

The HHI is a measure of market concentration, calculated by summing the squared market shares of participating firms. This metric theoretically ranges from zero (perfectly competitive) to 10,000 (pure monopoly). The U.S. Department of Justice considers a market with an HHI of less than 1,500 to be competitive, an HHI of 1,500 to 2,500 to be moderately concentrated, and an HHI of 2,500 or greater to be highly concentrated. [NEED TO ADD REFERENCE https://www.justice.gov/atr/herfindahl-hirschman-index]

NAICS Codes:

North American Industry Classification System (NAICS) codes define businesses based on the activities in which they are primarily engaged [NEED TO ADD REFERENCE https://www.census.gov/eos/www/naics/]. These codes are often used to present industry-related statistical data, such as in the U.S. Economic Census. NAICS codes have 2 to 6 digits; 2-digit codes represent highly aggregated sectors (e.g., 23: Construction), while 6-digit codes provide the greatest specificity (e.g., 236210: Industrial Building Construction).

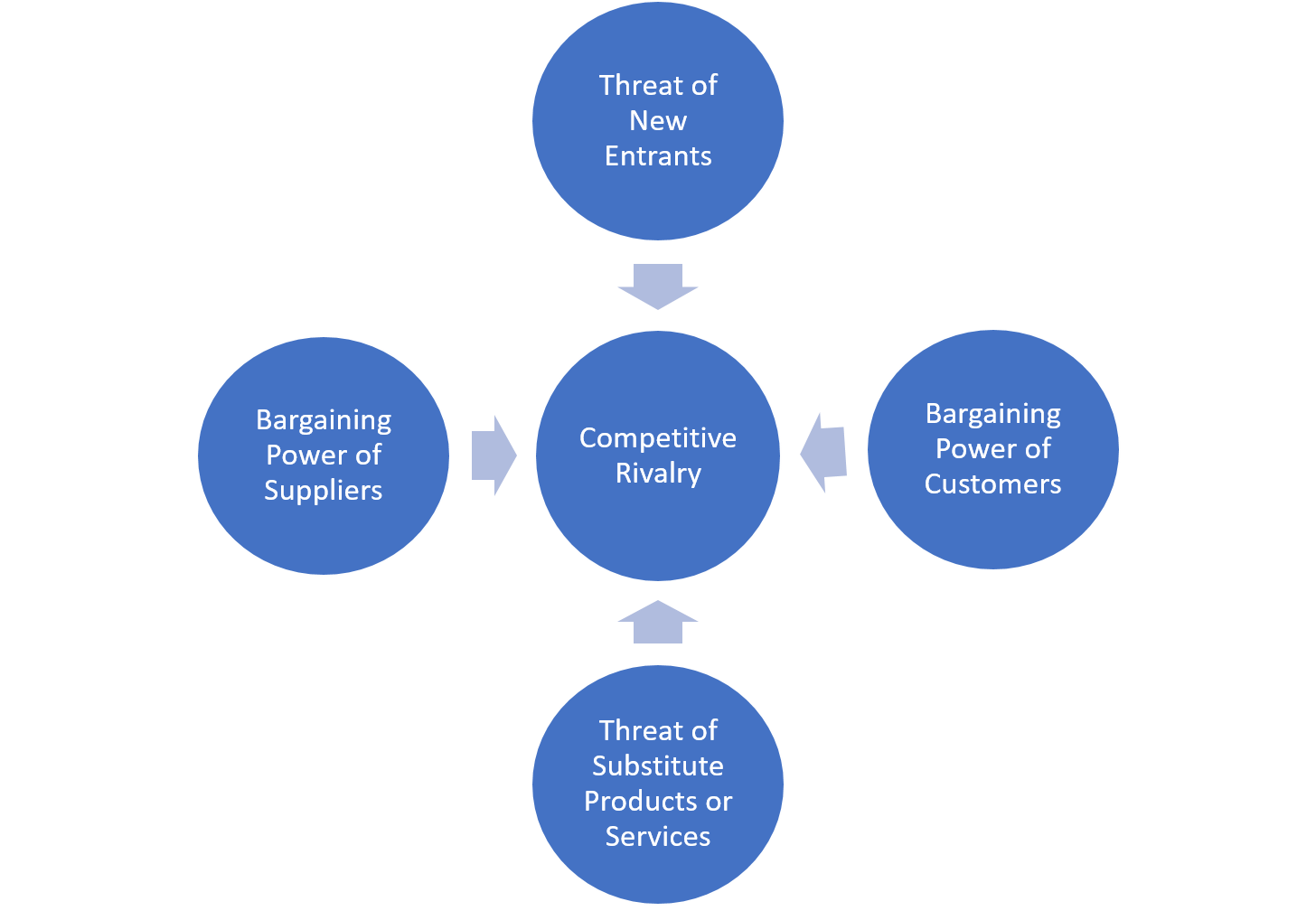

Porter’s Five Forces:

Porter’s five forces is a framework proposed by Michael Porter in 1979 that aims to evaluate the competitive intensity and the potential profitability (attractiveness) of an industry. Porter’s five forces include three forces from ‘horizontal’ competition–the threat of new entrants, the threat of established rivals, and the threat of substitute products or services –and two others from ‘vertical’ competition–the bargaining power of suppliers and the bargaining power of customers. The framework is illustrated in the figure below and characteristics of each of the forces will be discussed in details subsequently in the context of wind turbine manufacturing in the U.S.

Learning Curve – Learning Rate:

Estimation of learning curves has become essential in the renewable energy sector as it helps to model the potential cost reduction in the future and competitiveness of different technologies. The learning curve measures the rate of production cost decrease as quantity produced increases; cost reduction may be due to improvements in technology and manufacturing techniques. The data used to map a learning curve can be used to estimate the learning rate, or the average reduction in cost for each cumulative doubling of installed capacity.