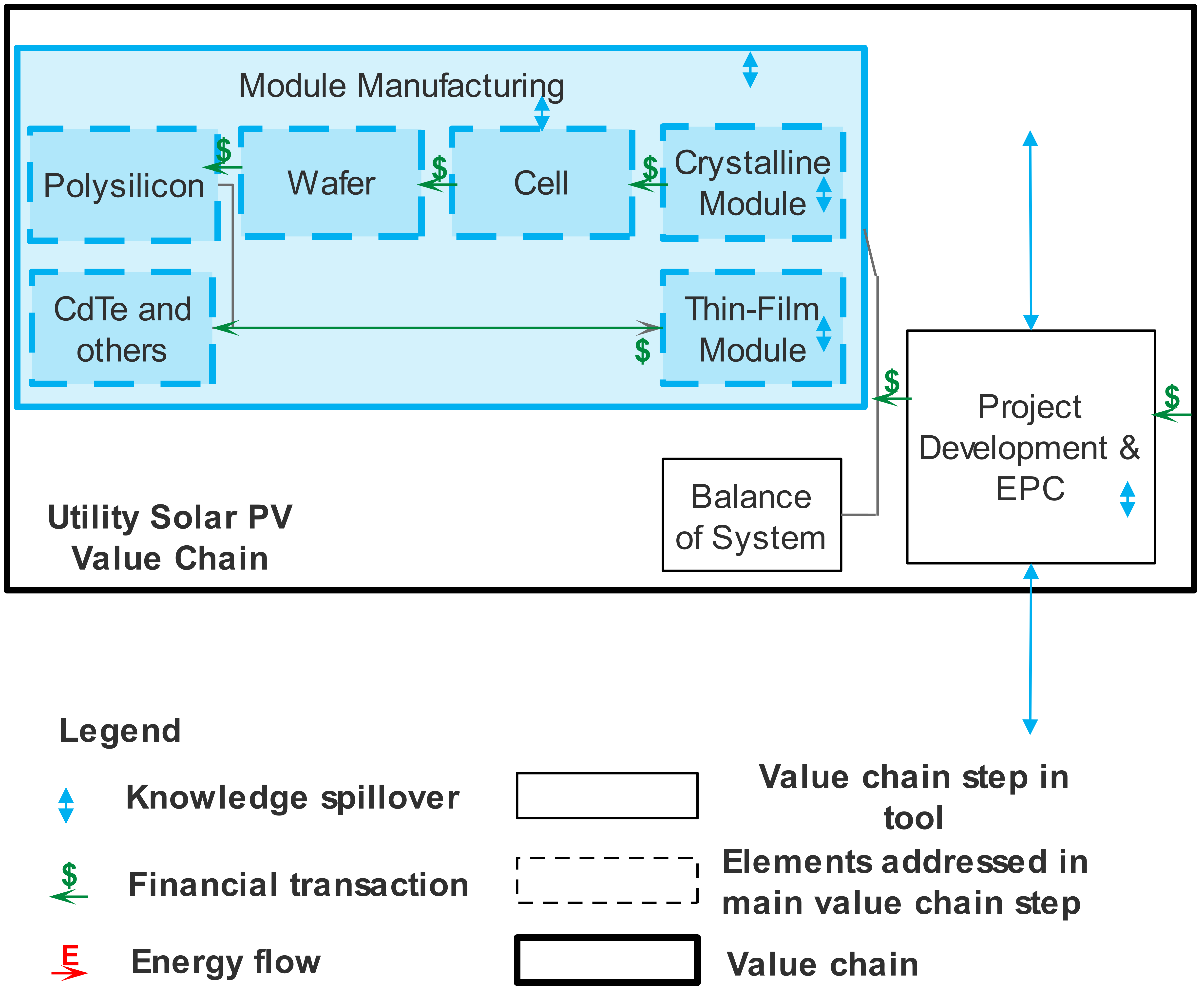

Historically, U.S. utility-scale PV has been dominated by crystalline silicon PV technology, in terms of installed capacity. In 2016, almost 70% of total came from crystalline silicon PV modules; thin-film PV modules represented about 28% of new solar capacity (EIA, 2017). Hence, in the PV module manufacturing, the first step of our utility-scale solar value chain, we focus on crystalline silicon and thin film PV modules, the 1st and 2nd generation of PV technology, as well as their intermediate components. The market structure of PV module manufacturing differs significantly by technology and the value chain sub-steps encapsulated within PV module manufacturing. PV module manufacturing is highly globalized, and currently Chinese manufacturers dominate the global market for PV modules, particularly in crystalline silicon modules. In 2018, seven of the top ten solar manufacturers were headquartered in China. The number of PV technology options has increased over the years, and diversity helps facilitate spillover across technologies and has the positive effects on stimulating innovation (Lacerda et al., 2016). It is expected to see more 3rd generation of PV technologies emerging on the market with higher efficiency performance, long-term durability and lower environmental impact during manufacturing process.

Select an information category (descriptive information, innovative outcomes, strategic conditions, and knowledge conditions) using the tabs to the left or navigate to a different value chain step using the drop-down menu at the top of the page.