Descriptive Text of Value Chain Step

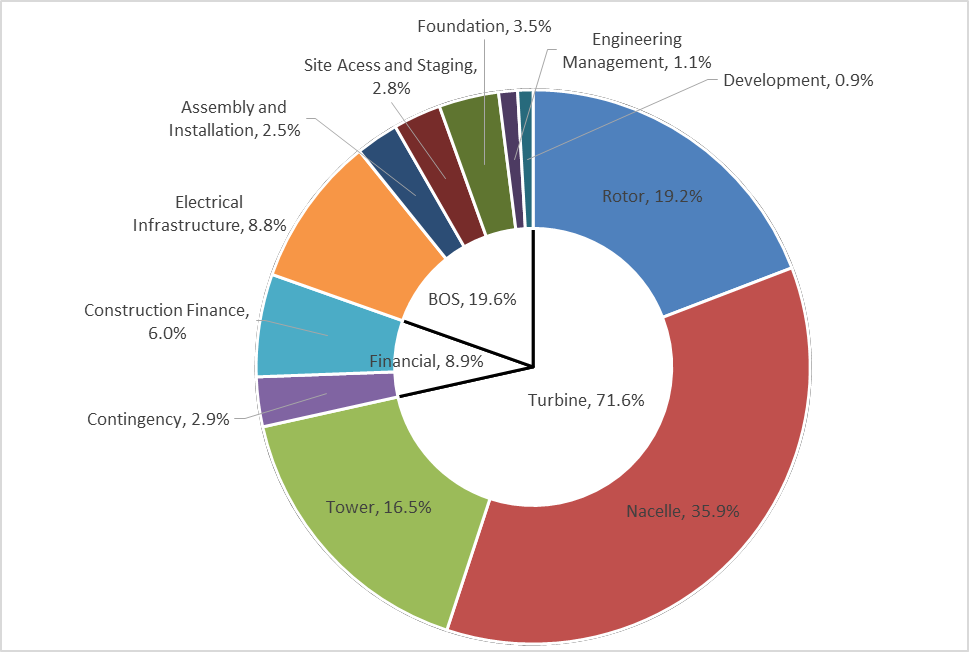

Project development and engineering, procurement and construction are commercial activities, which inevitably involves undertaking risk, operating on uncertain timeframes, and expending financial as well as political resources. A project developer typically initiates new wind projects and retains ownership of them during at least the early stages of development. Many project developers sell the wind project once it is brought onlineor as it nears operability, while others may retain ownership. Project development activities usually include: site selection, negotiations with landowners, the permit application and grid connection, and acquisition of financial resources. The project developer often appoints the engineering, procurement, and construction (EPC) contractor through in-house capacity or hires a firm specializing in EPC, and identifies the preferred power off-taker. The EPC is responsible for engineering and design, procurement of wind turbines and other balance of plant equipment and materials, and construction and commissioning of generation facilities. In our utility-scale wind value chain, “balance of system” (BOS) or “balance of plant” (BOP), referring to all infrastructural components of a wind project besides the turbine (i.e., cables, access roads, crane pads, foundations, collection networks, substations), are grouped as part of project development and EPC. For on-shore wind projects, the majority of the capital expenses are attributable to wind turbines, and the remainder are BOS and financing costs (Figure DI.5).

Project development and EPC activities of the wind value chain are included in the aggregate industries “Environmental Consulting Services” (NAICS 541620), “Research and Development in the Physical, Engineering, and Life Sciences” (NAICS 54171), “Power and Communication Line and Related Structures Construction” (NAICS 237130), “Utility System Construction Architectural, Engineering, and Related Services” (NAICS 5413), “Industrial building construction” (NAICS 236210), and “Electrical Contractors and other Wiring Installation Contractors” (NAICS 238210), among others. However, even at their most disaggregated level (six-digit codes), NAICS codes cover a range of components, products or services that are not specific to wind project activities.

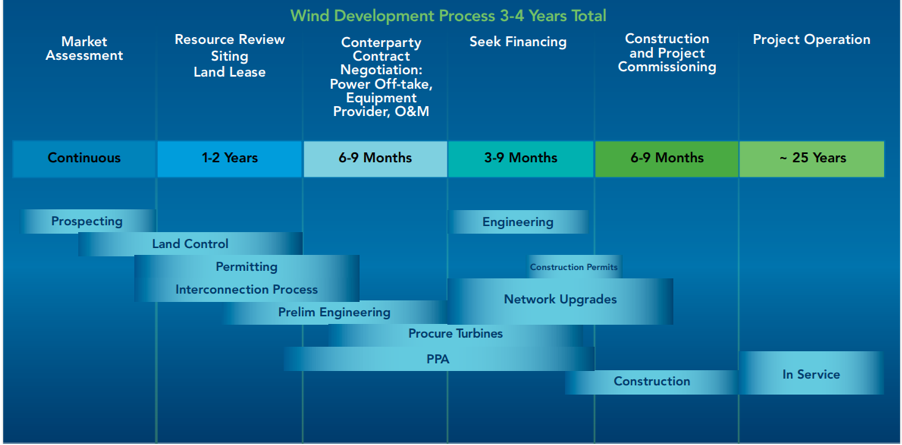

Below we provide brief descriptions of major project development and EPC tasks involved in developing a utility-scale wind project. See figure DI.1 for a timeline of major project development and EPC tasks required to complete a wind project.

Figure DI.1 Timeline of Development of a Wind Power Project

Source: Figure 4 from American Wind Energy Association 2017 U.S. Wind Industry Annual Market Report

Project Development

Land acquisition: The land rights needed to build a utility-scale wind project can be acquired through easement, lease, or fee title, depending on the project location and current owner of the land. For example, on federal land, a right-of-way may be granted under Title V of the Federal Land Policy and Management Act (FLPMA) if the proposed project is consistent with the land-use planning of the U.S. Bureau of Land Management (BLM). BLM manages approximately 21 million acres of public lands with sufficient wind potential across 11 Western states. Since 2008, BLM has approved 35 utility-scale wind energy projects with a total capacity of 3,287 MW for construction on public lands in the Western U.S.(Arizona, California, Idaho, Nevada, Oregon, Utah, and Wyoming). However, through 2017 only 1.1 percent of cumulative wind power capacity had been installed on public land owned primarily by the U.S. BLM and other federal agencies. The majority of U.S. on-shore installed wind power capacity is located on private land, such as farm land and ranches (AWEA 2017).

Wind resource analysis: The purpose of this step is to determine if a potential site has sufficient wind resources, and to project the amount of energy it will be able to produce, in order to determine the size and economic viability of the project and to inform negotiations with potential power off-takers. Wind resource analysis can be conducted using public data sources (e.g., NREL Wind Integration Datasets, Department of Energy WINDExchange) or independent wind resource analysts can be hired to perform this task.

Permitting: In the U.S., permits are required at the local, state and federal level to construct and operate the wind project and to sell the electricity produced. Typically, a wind project needs approval from a local land use board or zoning authority, a building permit, an electrical permit, and in some cases, a permit from the fire department. Wind projects located on federal lands may require permits from the BLM or the Department of Agriculture’s Forest Services. The complexity and time requirements of the permitting process can delay projects and create a barrier to developing utility-scale wind projects.

The permitting process varies among states and municipalities. Some states have a single agency or siting authority to process the project application; in other states, project developers may have to separately obtain permits from different state and local agencies. Project developers need to be familiar with the local authority having jurisdiction (AHJ) and specific building codes of relevance.

Many counties, towns, and other municipalities have ordinances regulating aspects of wind projects, such as: required minimum acreage per turbine, minimum setbacks from inhabited structures, maximum turbine height, appearance of turbines, sound thresholds at property lines, minimum ground clearance of blades, or zoning codes within which wind installations are allowed.

Transmission and interconnection: Utility-scale wind projects usually sell the electricity they generate to wholesale utility buyers. However, prime wind sites are often located far from urban centers where the electricity is needed, requiring new and sometimes lengthy transmission lines in order to reach utility substations. Compared to the wind project construction process, transmission expansion occurs on a relatively long timeframe, and requires navigation of its own set of federal and state entities and regulations, in particular the Federal Energy Regulatory Commission (FERC). Preemptive expansion of transmission capabilities supports the development of new wind resources (e.g., in 2017, six transmission projects enabling wind development were completed in the U.S. Midwest, Mid-Atlantic, and Plains regions).

Interconnection agreements are typically pre-approved by the state public utility commission and usually are not negotiable; interconnection requirements must be taken into account to avoid project delays. Interconnection of large generation sources (20 MW or greater) are generally subject to FERC approval. Size limits and interconnection procedures vary by state. Feasibility and impact studies evaluate the impact of the proposed wind project on electric grid reliability. The project developer must pay the costs required for the utility to accept an interconnection and for any facilities and upgrades that may be required to ensure the grid stability.

PPA and financing: In many cases, financing will need to be obtained to pay for the costs of getting the wind project up and running. Many factors can impact the financial viability of a utility-scale wind project, including the availability of preferential tariffs (e.g., feed-in tariffs), production or investment tax credits, and other policy incentives. One factor of key importance to potential lenders is the presence of a power purchase agreement (PPA). A PPA is a financial agreement with a power off-taker that specifies the terms under which electricity produced at the wind project will be sold (other related agreements, such as the loan agreement, grid connection agreement, and EPC contract, should align with the PPA). A typical PPA specifies: the rate to be paid for electricity or the method that will be used to determine it (e.g., fixed rate, reverse auction, marginal cost of supply, etc.), the installed capacity of the project, the predicted annual electricity production over the project’s lifetime, and the rights to any environmental credits accruing from the project. Other factors related to the wind project’s costs and expected revenues may also be specified in the PPA. According to AWEA’s 2017 annual report, long-term PPAs continued to be the preferred wind purchasing mechanism, and 62% of installed wind capacity were signed under PPA in 2017. Figure DI.2 provides a general timeline of wind project financing.

Figure DI.2 Timeline of Wind Project Financing

Source: Figure 62 from American Wind Energy Association (2017) U.S. Wind Industry Annual Market Report Year Ending 2017

Environmental review

Depending on the project size, location and other characteristics, a proposed wind project is usually subject to environmental review. This process evaluates the project’s impacts on natural, cultural or historical resources and wildlife, including consideration of the visibility of turbines within the broader landscape, detrimental effects on vulnerable species, and potential for disturbance of archeological and key heritage sites. Habitat and migration paths of birds and bats must be taken into consideration, though modern large, slow-spinning turbines pose a reduced threat to these animals as compared to previous generations of wind energy technologies. Utility-scale wind projects located on federal land typically require a review under the National Environmental Policy Act, and possibly a follow-up Environmental Impact Statement. At the state level, some states conduct this review simultaneously with the permitting process, and the details of the environmental review process differ between states.

Engineering, Procurement, and Construction (EPC)

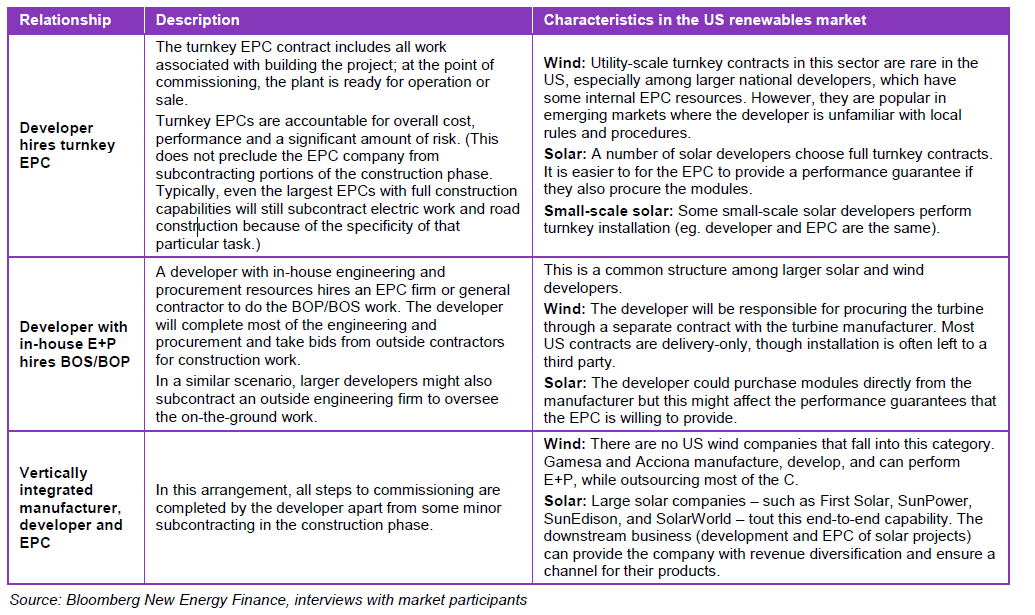

For many wind projects, the project developer hires an EPC firm to perform tasks other than those related to permits, financing, and legalities. In some cases, a company may be vertically integrated between manufacturing, development, engineering, and procurement (e.g., Gamesa), and there exist a wide range of possible arrangements of tasks between project developers and EPCs (Figure DI.3). EPC activities (e.g., design and engineering) may occur at the same time as project development tasks (e.g., finalization of legal agreements).

Figure DI.3: Examples of Relationships between Project Developers and EPCs

Source: Bloomberg New Energy Finance, interviews with market participants

A typical EPC’s functions in the process of commissioning an energy project can be broadly categorized as: engineering, procurement, and construction.

Engineering (E): The engineering phase, which can be up to a multi-year process for very large projects, begins with a site survey and feasibility analysis; it results in a full design of the wind project, including the number and arrangement of turbines, as well as buildings and roads that will be used for operations and maintenance activities. This design will be used to inform procurement needs and guide construction.

Procurement (P): Procurement entails the purchase of all physical equipment and materials and the hiring of all labor required to complete the wind project. Equipment and materials include construction vehicles and key generation infrastructure such as turbines. The timing of procurement activities impacts total installed project costs because early delivery may result in storage costs and late delivery may cause delays in construction. Transportation and delivery of wind project materials can be particularly complicated due to the large size of turbine components.

Construction (C): In the construction phase, the turbines are installed and all supporting infrastructure is built. For wind projects, the term “balance of plant” is used to refer to all components of a wind project apart from the turbines (e.g., cables, access roads, foundations). Generally, multiple companies will be involved in construction, with specific tasks (e.g., electrical systems, roads, etc.) subcontracted from a general contractor to specialists.

Labor

The project development and EPC processes in the wind industry require diversely- and highly-skilled laborers (BLS). Land acquisition specialists are responsible for acquiring land for wind development sites through purchase or lease. Atmospheric scientists or other wind resource specialists assess the suitability of a location for wind energy production. Environmental scientists perform the environmental review of the proposed site. Engineers design the placement of turbines and supporting infrastructure. Procurement specialists arrange for the purchase and delivery of all necessary equipment and materials. General and specialized contractors assemble the wind turbines and construct supporting infrastructure. Logisticians help keep transportation of large wind turbine components as efficient as possible.

The scale and profitability of the project development and EPC industries will be impacted by changes to the availability of these types of workers and changes to salaries. A recent NREL skills assessment of the U.S. wind industry provides detailed statistics on the current and predicted future wind workforce composition. According to the AWEA’s annual market report, the newly installed wind turbines in 2017, as well as other projects still under construction, required over 43,800 jobs related to development, transportation and construction, which is three times higher than the jobs supported in these sectors in 2013.

Relevant Figures

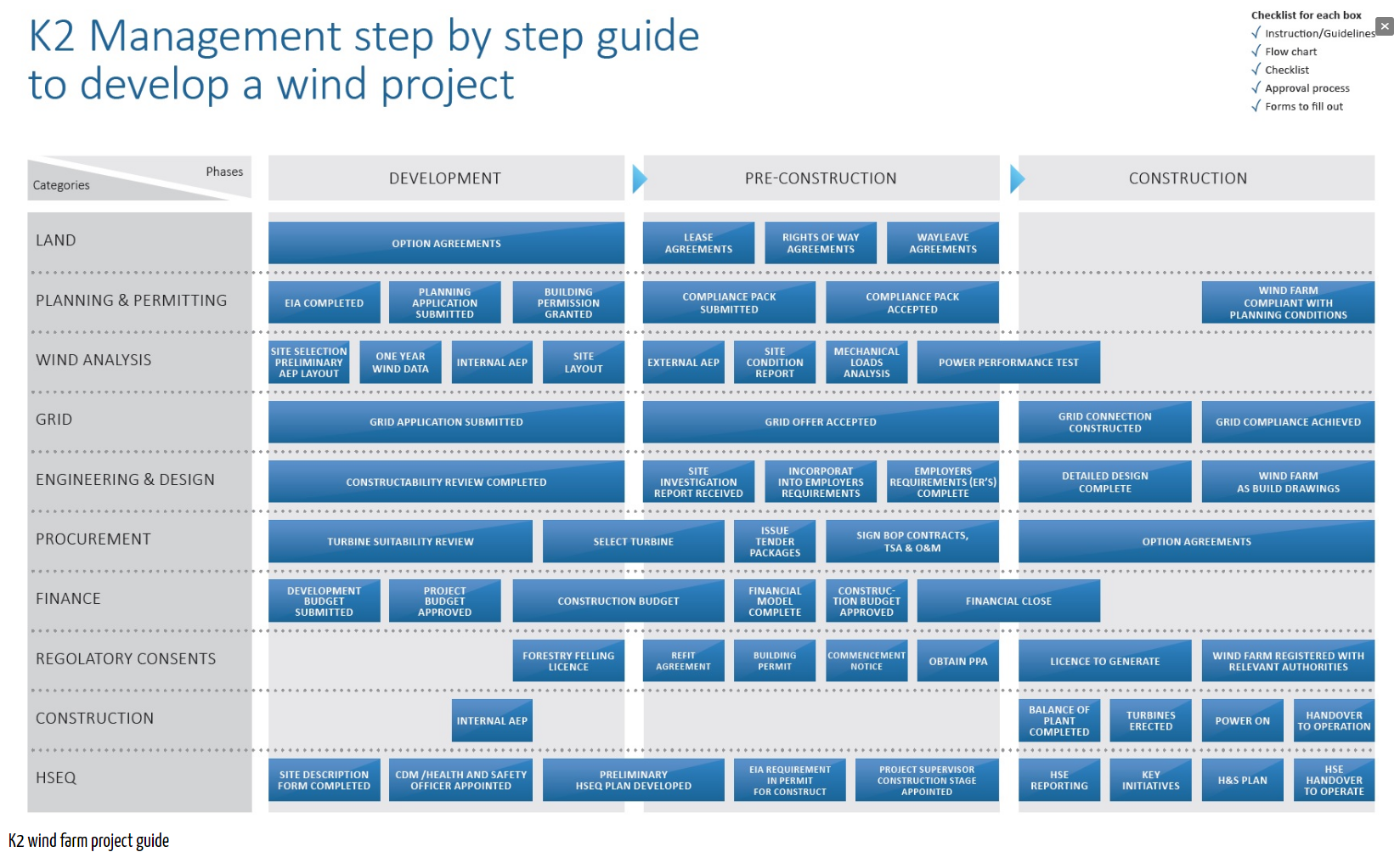

Figure DI.4 Step-by-Step Wind Project Development Guide

Source: http://www.windfarmbop.com/category/turn-key-wind-farms/

Figure DI.5 Capital Expenditures for the Reference Onshore Wind Plant Project

Source: Recreated from Figure 5 in Mone et al. (2017) 2015 Cost of Wind Energy Review, National Renewable Energy Laboratory Technical Report NREL/TP-6A20-66861.