Market Structure

The traditional market structure of LSEs is peculiar among industries because it consists of geographically disjoint legal monopolies. Each LSE, traditionally an investor-owned for-profit utility, provided electric service to all the electric users in that region (see Table SC.1 for a list of major U.S. IOUs). The IOU is thus not subject to competition, but is subject to direct economic regulation from its governing utility commission. This arrangement is still most common in the U.S. and accounts for 60% of electricity sold, in terms of MWh (EIA 2016 ); Table SC.2 provides a comparison of U.S. utility types across other metrics.

Table SC.1 Major Investor-Owned Utilities

Source: summarized from EIA Annual Utility Bundled Retail Sales for 2016, (Data from forms EIA-861- schedules 4A & 4D and EIA-861S)

| Load Serving Entity | State(s) Served | MWh Sold | Revenue ($1000) |

| Duke Energy | NC, SC, FL, IN, KY, OH | 199,387,332 | 17,849,164 |

| Entergy | AR, TN, LA, MS, TX | 112,597,475 | 8,084,621 |

| Florida Power & Light Co | FL | 109,449,144 | 10,086,584 |

| Georgia Power Co | GA | 84,872,503 | 7,815,209 |

| Virginia Electric & Power Co | VA, NC | 80,585,953 | 7,053,587 |

| Southern California Edison Co | CA | 74,248,701 | 10,384,504 |

| Pacific Gas & Electric Co | CA | 68,820,761 | 12,909,551 |

| Alabama Power Co | AL | 54,952,074 | 5395,202 |

| PacifiCorp | UT, OR, WY, WA, ID, CA | 54317937 | 4,772,440 |

Table SC.2 Comparison of Primary U.S. Utility Types

Source: Recreated from Table A-4 in DOE Electricity System Overview Appendix (2017)

| Utility Type | Number of Utilities | Number of Customers | Miles of Power Lines | |

| Transmission | Distribution | |||

| Investor-Owned Utilities | 169 | 107,600,000 | 3,467,000 | 459,500 |

| Municipal Utilities | 1,834 | 15,150,000 | 321,000 | 27,590 |

| Rural Electric Cooperative Utilities | 814 | 19,230,000 | 2,400,000 | 116,600 |

| Federal and Publicly-Owned Utilities | 124 | 5,280,000 | 333,700 | 95,960 |

| Total | ||||

Note: Municipal utilities are the most numerous of the various utility types, though IOUs serve far more customers. Rural electric cooperatives have a higher proportion of distribution miles per customer served than investor-owned or municipal utilities.

This market structure is changing and other forms of LSE are becoming more numerous. Publicly owned utilities operate similarly to IOUs (as monopolies in their territories), but their mission is to optimize benefits to local customers rather than to maximize return on investment (see Table SC.3 for a list of major U.S. POUs). Although this section of the value chain addresses only the load-serving aspect of utilities, both IOUs and POUs are typically vertically integrated, meaning that they own, operate, or manage generation and transmission resources as well as their retail load. Newer LSE structures are also emerging (see Table SC.4 for descriptions of various utility business models). CCA’s are overlay entities that make generation investments and/or procure energy on behalf of customers, but which rely on the incumbent utility to actually deliver the power over its distribution system as well as provide billing services. Nevertheless, CCAs provide a form of competition with traditional utilities.

Table SC.3 Major Publicly-Owned Utilities (Municipal, State, Federal)

Source: EIA Annual Utility Bundled Retail Sales for 2016 (Data from forms EIA-861- schedules 4A & 4D and EIA-861S)

| Load Serving Entity | Type | MWh Sold | Revenue ($1000) |

| Los Angeles Department of Water & Power | Municipal | 22,666,258 | 3,351,394 |

| City of San Antonio, TX | Municipal | 21,817,599 | 2,087,058 |

| Tennessee Valley Authority | Federal | 19,704,432 | 814,269 |

| Long Island Power Authority | State | 17,852,922 | 3,185,395 |

| City of Memphis, TN | Municipal | 13,721,843 | 1,233,376 |

| Austin Energy | Municipal | 12,939,762 | 1,203,997 |

| Nashville Electric Service | Municipal | 11,991,016 | 1,232,005 |

| JEA (Jacksonville, FL) | Municipal | 11,987,738 | 1,197,003 |

| City of Seattle, WA | Municipal | 9,259,627 | 788,029 |

Some states have various levels of deregulation of electricity markets such that there is retail competition. The rules vary significantly between states, with Texas representing the largest liberalized market in the U.S. Consumers can choose among an array of competing electricity suppliers, some offering green power, others inexpensive power, and other combinations of costs and benefits. Like CCAs, these Retail Electric Providers (REP) rely on an incumbent utility or Transmission and Distribution Service Provider (TDSP) to provide distribution services.

Table SC. 4 Utility Business Models

Source: Table A-5 from DOE Electricity System Overview Appendix (2017)

Porter’s Five Forces

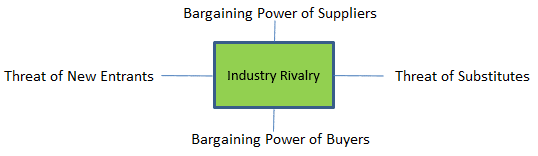

In this section, we explore Porter’s five forces as they relate to LSEs; specifically, these are: the threat of new entrants, the threat of established rivals, the threat of substitute products or services, the bargaining power of suppliers, and the bargaining power of customers. The framework is illustrated in Figure SC.1 below and characteristics of each of the forces will be discussed in detail subsequently in the context of LSEs.

Figure SC.1 Porter’s Five Forces

- Industry Rivalry

Traditional utilities do not compete with each other within any given territory, although parent companies of IOUs can own multiple IOUs across a wide geography and they may also have unregulated arms that compete as REP, ESP, TDSP, or in wholesale generation in wholesale markets or in other territories. With the rise of alternatives to IOUs/POUs, competition is now becoming more common in the load-serving space. Some states have liberalized to allow retail competition. This can take the form of retail providers, energy service providers, and direct access, where large customers can make their own direct arrangement with wholesale suppliers. Community Choice Aggregation (CCA) is also a form of competition, where an entity organized for the public benefit procures power on behalf of users who elect to participate. A CCA differs from a complete publicly owned utility in that it provides only the load aggregation and procurement functions, not the complete operation of a utility.

- Threat of New Entrants

Under the traditional regulated regime, new entrants are blocked by law. However, as more states move to deregulate, the possibility of new entrants increases. In areas with open retail competition such as Texas, the barrier to new entrants is quite low. If a company is willing to market to customers, able to make wholesale transaction to procure power on their behalf, and meets various rules set by the governing entity, it can become a retail electricity provider.

- Threat of Substitutes

Load serving entities face an array of substitutes. For example, customers can make investments in energy efficiency, thus reducing their overall electric use. Customers can also reduce their reliance on an LSE by electing to use different forms of energy by switching fuel. For example, a residential customer might switch from electric to gas heat.

Many electric users have started to “self-generate” by deploying generation resources “behind the meter,” without the utility involved. Often referred to as distributed generation, technologies such as rooftop PV, small wind turbines, small gas turbines, and cogeneration (combined heat and power) equipment, allow users to generate some or all of their electricity. The electric utility industry’s response to the advent of distributed generation suggests that traditional LSEs perceive increased distributed generation as a competitive threat (see, e.g., Wara 2016). Though relatively few end users have sufficient capacity to allow them to completely separate from their LSE, it is certainly possible. New technologies such as microgrids and distributed storage will further enhance this capability (see, e.g., DOE SunShot for a variety of ongoing research into distributed energy storage). Storage is key in helping to match the stochastic, time-varying nature of most renewable technologies to different time-varying needs of their loads. Microgrids allow the aggregation of load and generation over a relatively small area, such as a corporate campus.

- Bargaining Power of Suppliers

LSEs are responsible for obtaining sufficient power to meet their load, as well as making sure that supply meets reliability and deliverability constraints. As a result, their suppliers are typically merchant generators, transmission operators, project developers and power generation technology companies (in the case of self-owned projects) and fuel suppliers (in the case of self-owned fossil generators or for tolling arrangements in which the LSE has access to another entities power plant, but must provide their own fuel). As the LSEs break up into smaller and smaller units, their bargaining power with suppliers will be reduced. In other words, the bargaining power of LSEs’ suppliers will be higher.

- Bargaining Power of Buyers

An LSE’s customers are represented by all load in the service territory, including residential, small and medium commercial, industrial, and municipal. LSEs that find themselves with excess electricity, fuel, or capacity may also sell to other wholesale customers.

Overview of Geography

Traditional utilities are non-overlapping and non-competing, but geography does affect them in the sense that some resources, such as solar, wind and hydro, are highly dependent on geography. The distribution of users also affects an LSE’s operations. An LSE operating over a large area with few customers will have high investment in distribution per user, whereas an LSE operating over a small area with many customers will have a physically smaller system with less investment per user.

As forms of deregulation and more competition take hold, geography can be an important driver Figure SC.2 shows which states have deregulated their electricity retail markets as of 2018. Part of the justification for CCA is to let local communities make electric choices that better match their local preferences. The CCAs operating within a utility area, therefore, are expected to make different choices than the utility would have for the same load, and these choices will be driven by the heterogeneous preferences of the smaller geographical units covered. For example, whereas a utility might have to balance cost and low-GHG, CCAs can choose to optimize one over the other, based on the narrower preferences of their smaller geographic footprint.

Figure SC.2 Electric Market Regulation Status by State

Source: https://www.electricchoice.com/map-deregulated-energy-markets/

Using California as an example, note that the service territories of IOUs and POUs largely do not overlap (Figure SC.3 and SC.4). CCA service territories do overlap with those of IOUs; for example, Marin Clean Energy overlaps with PG&E in Marin County and Sonoma Clean Power overlaps with PG&E in Sonoma and Mendocino Counties. Figure SC.5 presents IOU territories across the U.S. and Table SC.5 provides a summary of the number of utilities of various types by state.

Figure SC.3 California POU Territories

Source: California Energy Commission website http://www.energy.ca.gov/maps/

Figure SC.4 California IOU Territories

Source: California Energy Commission website http://www.energy.ca.gov/maps/

Figure SC.5 U.S. IOU Territories

Source: http://www.eei.org/about/members/uselectriccompanies/Documents/EEIMemCoTerrMap.pdf

Table SC.4 Number of Utilities by Type by State

Source: Summarized from EIA form 860 data

| IOU | POU/Municipal | IPP* | Other | |

| AK | 8 | 15 | 3 | 21 |

| AL | 2 | 3 | 7 | 12 |

| AR | 1 | 9 | 3 | 8 |

| AZ | 7 | 6 | 38 | 4 |

| CA | 18 | 72 | 274 | 156 |

| CO | 4 | 15 | 51 | 12 |

| CT | 3 | 7 | 51 | 21 |

| DC | 0 | 3 | 14 | 0 |

| DE | 0 | 3 | 13 | 5 |

| FL | 21 | 20 | 129 | 30 |

| GA | 7 | 7 | 12 | 49 |

| HI | 5 | 1 | 9 | 4 |

| IA | 2 | 75 | 29 | 14 |

| ID | 2 | 3 | 33 | 13 |

| IL | 2 | 39 | 71 | 38 |

| IN | 7 | 7 | 5 | 26 |

| KS | 3 | 56 | 10 | 9 |

| KY | 2 | 3 | 3 | 6 |

| LA | 3 | 7 | 8 | 24 |

| MA | 10 | 23 | 153 | 33 |

| MD | 8 | 8 | 63 | 28 |

| ME | 3 | 3 | 24 | 12 |

| MI | 14 | 29 | 28 | 27 |

| MN | 9 | 59 | 76 | 22 |

| MO | 4 | 37 | 3 | 7 |

| MS | 3 | 3 | 4 | 5 |

| MT | 3 | 1 | 9 | 6 |

| NC | 6 | 10 | 241 | 99 |

| ND | 2 | 2 | 4 | 3 |

| NE | 1 | 45 | 19 | 5 |

| NH | 1 | 0 | 15 | 6 |

| NJ | 30 | 8 | 86 | 40 |

| NM | 2 | 5 | 7 | 10 |

| NV | 4 | 3 | 19 | 5 |

| NY | 16 | 18 | 161 | 34 |

| OH | 15 | 22 | 29 | 35 |

| OK | 4 | 11 | 9 | 6 |

| OR | 4 | 11 | 29 | 15 |

| PA | 13 | 8 | 133 | 46 |

| RI | 3 | 3 | 12 | 4 |

| SC | 3 | 8 | 9 | 7 |

| SD | 2 | 2 | 4 | 5 |

| TN | 0 | 7 | 17 | 16 |

| TX | 16 | 23 | 191 | 91 |

| UT | 1 | 19 | 27 | 14 |

| VA | 7 | 16 | 33 | 17 |

| VT | 1 | 7 | 7 | 5 |

| WA | 5 | 16 | 26 | 18 |

| WI | 9 | 20 | 21 | 19 |

| WV | 0 | 0 | 8 | 1 |

| WY | 0 | 0 | 1 | 9 |

*Note: An independent power producer (IPP) is not a utility or LSE, but which owns facilities to generate electric power to sell to utilities and end users. It should be more relevant to the “generator” section of the power market framework.

Overview of Governance

Since the Public Utility Holding Company Act of 1935 (PUHCA), utilities have been subject to substantial governance, as they exhibit many key features of natural monopolies (e.g., costs can be minimized by avoiding duplication of infrastructure). Under the “regulatory compact,” utilities accept an obligation to provide service at rates that will compensate for costs incurred. If unregulated, monopolies have incentive to underprovide a product or service at a higher price than would clear the market under a competitive environment. State PUCs oversee the operations of IOUs to ensure cost recovery via reasonable rates, infrastructure safety, and service reliability. The right of states to regulate natural monopolies, independent of federal antitrust scrutiny, is supported by the State Action Immunity doctrine, as framed in Parker v. Brown) and related federal cases, and the Filed Rate doctrine, as codified in the Communications Act, which forbids a regulated entity from charging rates other than those on file with their regulatory authority (Wara 2017). The Federal Power Act gives states the authority to regulate retail and intrastate electricity markets, but in the case of interstate transactions and wholesale markets there is federal regulation under the Federal Energy Regulatory Commission (FERC); see Figure SC.6 for more detail.

Governing Bodies

Traditional IOUs have to comply with their governing regulatory entities, often called public utility commissions (PUCs), which approve their rate cases. PUCs’ authority over utilities can be very broad. They often will set standards for fuel and resource mix, loading order, hedging strategy, and resource adequacy. They can also apply additional constraints such as Renewable Portfolio Standards (RPS), define operational rules and standards, require the implementation of certain programs such as demand response (DR), net energy metering (NEM), and energy efficiency (EE), define rate classes (residential, commercial, industrial, municipal, agricultural, etc.), and may require special rates for low-income customers. POUs are generally self-governed and exempt from PUC oversight due to their not-for-profit nature.

Because LSEs also perform wholesale transactions, they will also be subject to FERCs rules for wholesale transactions and access to the transmission system. LSEs that own or operate transmission and generation resources will also deal with various environmental regulations, though in the taxonomy of this tool, we are considering those roles of LSEs as separate activities and discuss them in the transmission & wholesale market, and generation sections, even though many firms cover more than one of these activities.

Figure SC.6 Regulatory Jurisdictions in Electricity

Source: Figure A-5 from DOE Electricity System Overview Appendix (2017)

Key Regulations

Renewable Portfolio Standard (RPS)

On the state level, renewable portfolio standards (RPS) require utilities to generate a certain portion of their electricity from renewable sources. Propensity to adopt an RPS varies by state and may be influenced by the politics of the state legislature, the strength of state regulatory authorities, the presence of an in-state renewable energy industry, and a state’s reliance on the natural gas or coal industry (Herche 2017). [8] Currently 29 states and Washington D.C. have established renewable portfolio standards and an additional 8 states have non-binding voluntary renewable goals (Figure SC.7). RPS requirements are thought to be responsible for 60% of the total increase in U.S. renewable electricity generation since 2000. (SEIA 2016)[1] The National Conference of State Legislatures provides additional information on renewable portfolio standards by state.

Figure SC.7 Nationwide Renewable Portfolio Standard Policies

Source: DSIRE database, www.desireusa.org http://ncsolarcen-prod.s3.amazonaws.com/wp-content/uploads/2017/03/Renewable-Portfolio-Standards.pdf

Public Utility Regulatory Policy Act (PURPA)

The Public Utility Regulatory Policies Act of 1978 (PURPA) aimed to enable “qualifying facilities” (e.g., small renewable energy generators, cogeneration projects) to compete in the electric sector. Two key features of PURPA are the right of qualifying facilities to interconnect with a utility-controlled grid and the mandatory purchase obligation. Under the mandatory purchase obligation, utilities were required to purchase a qualifying facility’s energy at “avoided cost” (i.e., the cost to the utility to generate or purchase that amount of energy in the absence of the qualifying facility). In the years following the initiation of PURPA in 1978, many contracts emerged between IPPs and pre-existing vertically integrated utilities.

Quantitative Measurement of Imperfect Competition

Because many LSEs act as regulated monopolies in their service areas, the usual market concentration measures (FFCR, HHI, etc.) are not particularly useful for exploring competition and market power in this industry (see, e.g., Borenstein et al. 1999, Gilbert and Newbery 2007). Numerous factors other than the number and size of firms impact the level of competition within an industry, such as: incentives of the diverse set of electricity-providing firms, customer price elasticity of demand for electricity, and potential for short-term entry into the market, dependent on transmission constraints (Borenstein et al. 1999). Borenstein et al note that while the 1997 California electricity market, for example, appears unconcentrated by traditional measures due to a diverse set of electricity producers (IOU, POU, non-utility, and imports from regional markets), there was in fact the potential for the exercise of high market power in hours with high demand. Once many of the producers are operating at full capacity, the remaining producers can engage in strategic behavior. As discussed in Gilbert and Newbery (2007), due to the inability to store significant amount of electricity, the “market” for electricity is more accurately viewed as separate markets for electric supply in each hour of each day, in some cases further subdivided into day-ahead and real-time markets. While regulatory entities like public utility commissions are designed to mitigate market power impacts of the monopolistic nature of the load serving space, individual LSEs may be able to exert significant market power over short time frames.

We also note that in some circumstances, the largest vertically integrated IOUs may hold some competitive advantages over smaller LSEs (e.g., ability to negotiate lower per unit prices for bulk purchases of equipment). Vertically integrated utility-, generation-, and transmission-owning companies may compete with each other to acquire subsidiary companies and gain dominance in certain geographically distinct markets.

Four Firm Concentration Ratio (FFCR)

For consistency with the data provided in other value chain segments, we include the four firm concentration ratio for electric utilities and electricity distribution (Table SC.6). However, as discussed above, the FFCR and HHI may not accurately represent the ability of firms in this industry to exercise market power.

Table SC.6 Four Firm Concentration Ratio (FFCR) for Electric Power Generation, Transmission, and Distribution (NAICS 2211) and Electric Power Distribution (NAICS 221122)

Source: 2007 U.S. Economic Census, Utilities: Subject Series – Establishments and Firm Size: Summary Statistics by Concentration of Largest Firms for the United States: 2007

| NAICS | Firms | Number of Establishments | Number of Employees | Revenue ($1,000) | Total revenue from large firms (%) |

| 2211 | All firms | 9,554 | 511,487 | 445,693,484 | 100.0 |

| 2211 | 4 largest firms | 770 | 67,129 | 66,671,244 | 15.0 |

| 2211 | 8 largest firms | 1,176 | 130,510 | 119,303,717 | 26.8 |

| 2211 | 20 largest firms | 3,860 | 259,388 | 238,954,814 | 53.6 |

| 2211 | 50 largest firms | 5,784 | 384,056 | 343,709,798 | 77.1 |

| 221122 | All firms | 7,546 | 382,580 | 320,458,395 | 100.0 |

| 221122 | 4 largest firms | 713 | 63,736 | 56,828,512 | 17.7 |

| 221122 | 8 largest firms | 1,013 | 105,685 | 98,414,219 | 30.7 |

| 221122 | 20 largest firms | 3,501 | 205,200 | 185,020,891 | 57.7 |

| 221122 | 50 largest firms | 5,076 | 296,240 | 258,111,236 | 80.5 |

Herfindahl-Hirschman Index (HHI)

There is a substantial volume of research surrounding alternative measures of market power in the electricity sector. Other methods discussed in the research include:

- Competitive Residual Demand analysis (see, e.g., Gilbert and Newbery 2007)

- Game-theoretical modeling approaches of strategic firm behavior, such as the Cournot-Nash model (see, e.g., Borenstein et al. 1999), supply function equilibrium model (Baldick et al. 2004)

- Price-cost markup measures, such as the Lerner Index, defined as (P-MC)/P and ranging from zero when price is equal to marginal cost to near one when marginal cost is a minor portion of the price charged to consumers; studies comparing market price and marginal cost include Borenstein et al. (2002).

- Dynamic market simulations

We do not attempt to calculate the HHI for U.S. LSEs, but instead summarize measures of market concentration as calculated by others for various U.S. regions:

- Texas (2015): HHI score of 440

- California (2000): HHI score of 632

Table SC.7 provides HHI estimates by state calculated in the context of potential market power in electricity generation ownership as it could impact emissions allowance trading programs.

Table SC.7 HHI Estimates by State (2010)

Source: Table 2 from U.S. Environmental Protection Agency Technical Support Document for the Transport Rule Docket ID No. EPA-HQ-OAR-2009-0491

| State | HHI Score |

| Alabama | 4,715 |

| Arkansas | 1,676 |

| Connecticut | 1,869 |

| Delaware | 4,652 |

| Florida | 1,471 |

| Georgia | 5,429 |

| Illinois | 2,557 |

| Indiana | 1,555 |

| Iowa | 3,634 |

| Kansas | 4,898 |

| Kentucky | 2,176 |

| Louisiana | 1,817 |

| Maryland | 4,522 |

| Massachusetts | 2,464 |

| Michigan | 4,356 |

| Minnesota | 4,022 |

| Mississippi | 5,129 |

| Missouri | 3,844 |

| Nebraska | 4,121 |

| New Jersey | 3,361 |

| New York | 758 |

| North Carolina | 4,709 |

| Ohio | 2,040 |

| Oklahoma | 2,090 |

| Pennsylvania | 1,096 |

| South Carolina | 4,068 |

| Tennessee | 10,000 |

| Texas | 956 |

| Virginia | 3,254 |

| West Virginia | 4,059 |

| Wisconsin | 2,644 |

Firm Economic Data Table

Table SC.8 lists firm revenues, number of employees, as well as location of headquarter and manufacturing facilities. More detailed firm information can be found in their annual report or company website (link provided).

Table SC.8 Major Load Serving Entities

Source: Statista list of top U.S. utilities by market value; revenue and generation capacity from companies’ 2017 annual reports and 10-K filings

| Utility/Utility-owning company | Market Value (billion $ as of May 2018) | Revenue ($billion in 2017) | generating capacity (MW) | Description | Website |

| Exelon | 39.2 | 33.53 | 32,700 | Exelon Generation, Constellation wholesale, and numerous utilities involved in transmission and delivery in NJ, MD, PA area | http://www.exeloncorp.com/ |

| Duke Energy | 56.2 | 23.60 | 49,500 | Duke utilities in NC, SC, TN, FL, KY, OH, IN, generation, commercial transmission | https://www.duke-energy.com |

| Southern Company | 45.5 | 23.03 | 46,000 | Alabama Power and other utilities in southern U.S., as well as generating capacity across many states | https://www.southerncompany.com/ |

| NextEra Energy | 75.8 | 17.20 |

46,790 |

Florida Power & Light Company, as well as generating capacity covering a wide geography | http://www.nexteraenergy.com/ |

| PG&E | 22.4 | 17.14 | 7,687 | Pacific Gas and Electric Company, generation and transmission capacity in CA | http://www.pgecorp.com/corp/index.page |

| American Electric Power | 33.1 | 15.4 | 26,000 | generation, transmission, distribution across AR, IN, KY, LA, MI, OH, OK, TN, TX, VA, WV | https://www.aep.com/ |

| FirstEnergy | 16.2 | 14.02 | 5,000 | electric utilities in OH, PA, NJ, WV, MD, generation and transmission | https://www.firstenergycorp.com/fehome.html |

| DTE Energy | 18.6 | 12.61 | 11,602 | electric utility in MI, generation, transmission, and marketing | https://www.dteenergy.com/ |

| Dominion Resources | 42.2 | 12.59 | 25,700 | electric utilities and transmission in NC and VA, generating capacity across additional states | https://www.dominionenergy.com/ |

| Edison International | 20.3 | 12.30 | 3,175 | Southern California Edison, distribution and transmission, | https://www.edison.com/ |

| Consolidated Edison | 23.9 | 12.08 | 2,090 | electric utilities and transmission in NY and NJ, ESCO, wholesale marketer in NE, NY, PJM, ERCOT, and CA ISOs | https://www.conedison.com/en |

| Xcel Energy | 23 | 11.70 | 17,000 | generation, transmission, electric utilities across CO, MI, MN, NM, ND, SD, TX, WI | https://www.xcelenergy.com/ |

| Entergy | 14.3 | 11.00 | 30,000 | electric utilities in AR, LA, MI, TX and generation | www.entergy.com |

| Public Service Enterprise Group | 25.8 | 9.1 | 12,000 | generation in NJ, NY, PA, and CT, solar facilities across the U.S., and utilities in NJ and NY | https://corporate.pseg.com/ |

| Eversource Energy | 18.4 | 7.75 | 1146 | electric utilities, generation, transmission, and distribution in NH, MA, CT | https://www.eversource.com/ |

| WEC Energy Group | 19.5 | 7.47 | 8,700 | electric utilities in WI and MI, generation and project development | https://www.wecenergygroup.com/ |

| PPL | 19.4 | 7.45 | 8,000 | electric utilities, generation and transmission in KY, PA, VA, TN, and the United Kingdom | https://www.pplweb.com/ |

| CMS Energy | 12.8 | 6.58 | 5,759 | Consumers Energy Company and generation, transmission, distribution capacity in MI | https://www.cmsenergy.com/ |

| Ameren | 13.9 | 6.18 | 16,900 | electric utilities in MO, IL, generation, transmission, distribution | https://www.ameren.com/ |

| Vistra Energy | 12 | 5.43 | 41,000 | electric utilities, generation in CA, TX, IL, New England, operates in multiple US wholesale markets | https://www.vistraenergy.com/ |