Descriptive Text of Value Chain Step

In the power markets value chain, “Generators” represent all the entities that operate electric generation equipment feeding into the transmission system, including facilities run by vertically integrated utilities that also participate in most other elements of the power value chain, as well as “merchant generators,” whose only role in the power markets value chain is to generate electricity and sell into the wholesale market. Our value chain analysis also has separate sections for the value chains for specific generation technologies [links]. This section describes generation more generically from the perspective of an owner/operator rather than a technology manufacturer or construction firm. Fundamentally, all generators partake in the activity of operating an electric generation resource to earn revenue.

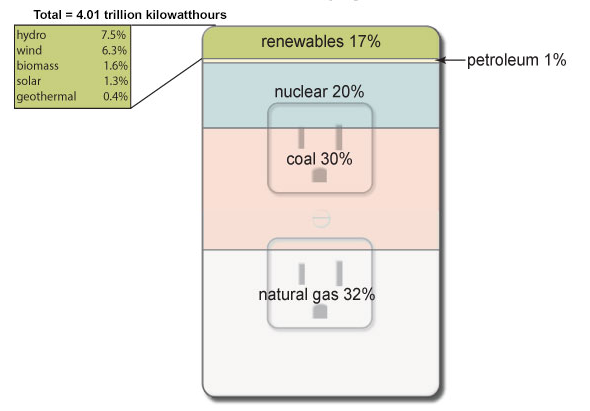

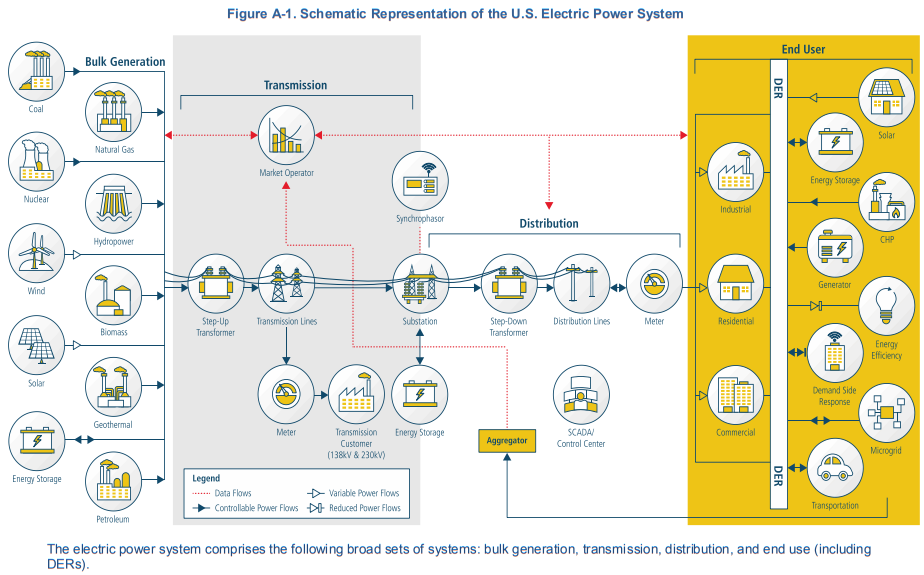

Many types of generation assets are used in the U.S. electricity system (Figure DI.1 and Figure DI.2). Fossil fuel generators include coal steam units, natural gas steam units, natural gas combustion turbines, natural gas combined cycle machines, integrated coal gasification combined cycle machines, and others. Some generators are internal combustion engines run on diesel. Landfill gas and municipal waste streams are also used as generation fuels, though they are not usually considered fossil fuels. Renewable energy generation sources include utility scale PV, wind turbines, hydroelectric, and geothermal. Some generators are powered by excess heat from an industrial activity (cogeneration); cogeneration systems are typically customer-sited and may reduce a customer’s electricity use as seen by its normal electric supplier, or may be used to sell energy back into the system (see, e.g., FERC on “Qualifying Facilities”). Fossil fuel generators are sources of emissions of greenhouse gasses and other criteria air pollutants, and are subject to related environmental regulations (see, e.g., EIA annual environmental data).

Operations: From an operations perspective, there are activities that all generators must pursue, while other activities are specific to the type of generation facility. For example, all generators need to maintain their equipment, though the maintenance itself obviously varies in nature. This includes routine maintenance as well as periodic overhaul, if the equipment requires it. Like any large physical asset, generators have costs associated with ownership, such as land rent, insurance, debt service, and employee payroll. Generators that are non-renewable, such as coal and gas powered machines, also need to procure and deliver fuel. As is the case with so much procurement in the energy business, generators typically choose to manage price risk for fuel supplies by forward contracting over various terms, purchasing options to buy fuel, and pursuing other financial hedges against fuel prices. This is somewhat complicated by the fact that generators do not always know in advance how often they will run and at what output level.

Sales of Output and Capacity: Generators sell their output in order to earn revenue. This is obviously important for non-utility generators run by for-profit organizations, but even for vertically integrated utilities, ensuring that the generator maximizes value is very important to the utility’s net revenue.

Generators typically sell their energy output as well as their capacity (i.e., the ability to generate even if not expected to do so). Capacity performs an important system reliability function, making sure that a load serving entity can meet its load even if load increases suddenly, certain transmission links fail, or other generators fail to deliver for any reason. A generator’s available capacity can be sold as one or more of various “capacity products.” Capacity products are defined over different time-scales, from seconds (often called “regulation”) to minutes (“spinning reserve”) to hours (“non-spinning reserve”) to months or longer (“resource adequacy”). The first three are often included in a group of short-term capabilities called “ancillary services.” The exact definitions, names, and rules regarding various capacity products vary by the transmission system that the generators is selling into, but what they have in common is the ability to change output under direction from operators within a defined time interval. Most transmission operators include the ancillary services in their market operations. Some transmission operators undertake the running of a capacity market for longer-term capacity (e.g., the Pennsylvania, Jersey, Maryland Power Pool, “PJM”), while others rely on another entity, such as the California Public Utility Commission providing resources to the California Independent System Operator (CAISO), to enforce capacity requirements.

Generators in deregulated power markets may bid their energy and services into the market directly through computer systems operated by the independent system operator or regional transmission organization (ISO/RTO) (see, e.g., CAISO bid process). They can also engage in bilateral contracts with other entities attached to the same transmission system, such as load serving entities (LSEs) or other generators. In places where organized power markets exist and generators are operating against bilateral contracts, they will still typically enter their expected output flows into the market system as “self-schedules”, so that the transmission operator can properly account and plan for them. In vertically integrated systems, an LSE dispatches a generator directly according to its needs.

Generator energy contracts can be structured in essentially unlimited ways, as required by the participating parties, and many types are seen in the industry. A generator may contract with an off-taker for some or all of its output over any length of time, from hours to years. Contract price agreements can take many forms: fixed pre-negotiated prices, variable prices tied to external benchmarks such as fuel prices, or prices tied to a predetermined escalator, or combinations therein. Contracts can be for firm energy deliveries, or take the form of an option to buy energy. Some generators enter into a tolling arrangement, in which for a fee, the plant is operated according to the dispatch of the counterparty, who also provides fuel.

Many renewable generators do not need fuel but are very capital-intensive to build. As such, it is difficult to finance such projects unless the future risk of being unable to sell the energy at a sufficiently high price has been removed. As a result, renewable projects often enter into power purchase agreements (PPAs). These contracts are usually long term (in excess of 10 years, and 20 or 30 year contracts are common), with pre-negotiated prices. In order to finance projects, it is also usually important that the counterparty be highly credit-worthy. A common structure in solar and wind PPAs is “take or pay,” which indicates that the off-taker (buyer) pays for energy actually produced and taken or pays for energy that could have been produced, but was not because it could not be taken. The latter situation results most often from “curtailment,” when due to system conditions, such as general oversupply or transmission congestion, it is not feasible or economic for a wind or solar project to inject power into the transmission system, so it is forced to curtail its output. Such a structure protects the project owner from the risk that external factors will limits the ability of their facility to earn revenue.

Figure DI.1 Sources of U.S. Electricity Generation (utility-scale facilities), 2017

Source: U.S. Energy Information Administration, Electric Power Monthly, February 2018, preliminary data.

Figure DI.2 Bulk Generation in U.S. Electric Power System, 2017

Source: Figure A-1 from U.S. Department of Energy (2017) Transforming the Nation’s Electricity System: The Second Installment of the Quadrennial Energy Review, Appendix: Electricity System Overview.