Market Structure

Porter’s Five Forces

This section is intentionally left blank. Please go see the “Wind Turbine Manufacturing” step for a more detailed discussion regarding strategic conditions in wind turbine manufacturing industry.

Overview of Geography

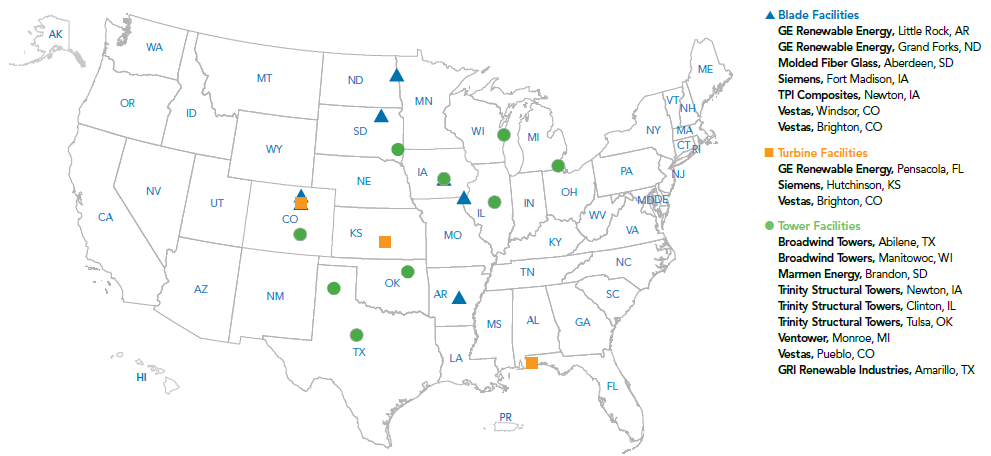

There are seven blade manufacturing facilities in the U.S., located in five different states (Figure SC.1). For more discussion on the role geography plays in the wind turbine manufacturing industry, please see the “Wind Turbine Manufacturing” step. Table SC.1 provides more details on the major tower manufactures. According to the DOE report, 70 to 90 percent of towers are manufactured domestically, primarily due to the logistic difficulty in transporting them in long distance.

Figure SC.1 Locations of Major Wind-related Manufacturing Facilities in 2017

Source: Figure 83 from AWEA 2017 U.S. Wind Industry Annual Market Report

Firm Economic Data Table

Table SC.1 lists firm revenues, number of employees, as well as location of headquarter and manufacturing facilities. More detailed firm information can be found in their annual report or company website (link provided)

Table SC.1 List of Tower Manufacturers in the United States

Source: Created by authors based on company’s annual financial report or online website

| Company Name | Headquarter Location | Manufacturing Location(s) | Number of Employees | Revenue (million) | Source |

| Broadwind Towers | Cicero, IL | Abilene, TX

Manitowoc, WI |

650 | $146.8 ($103.4 for Towers segment) | 2017 10-K Form |

| Marmen Energy | Brandon, SD | Brandon, SD | 201-500 | n/a | Company website |

| Trinity Structural Towers | Dallas, TX | Newton, IA

Clinton, IL Tulsa, OK |

n/a | n/a | Company website |

| Ventower | Monroe, MI | Monroe, MI | 11-50 | n/a | Company website |

| Vestas | Aarhus, Denmark | Pueblo, CO | 4,000 (at Pueblo facility) | $11,634 | 2017 Annual Report |

| GRI Renewable Industries | Madrid, Spain | Amarillo, TX | 1,001-5,000 | n/a | Company website |